April: First full month of sales in the pandemic.

It’s been an unusual ride thus far navigating real estate sales through this pandemic. I have many clients, friends and family inquiring about the local real estate market. What is it like? Has the pandemic affected sales and home values? Will the market tank? While I do not have a crystal ball I do have some statistics to share that can provide some insight into how the market is faring. Since we just finished our first full month in a pandemic, let’s compare April to the first quarter of 2020 and to April 2019.

*Note: Charts depict statistics taken from residential sales in the city of London in 2020.

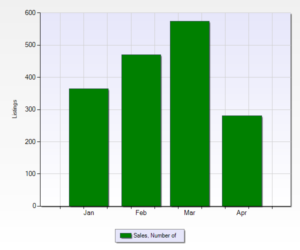

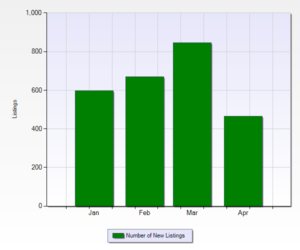

Number of Sales/Number of New Listings

Let’s start with the not-so-great-news. Sales are down in April compared to the first 3 months of the year. In April we saw 281 residential sales compared to 574 in March, 470 in February and 364 in January. April 2020 numbers are down 51% from March 2020 and down 59% from April 2019. Now, this is to be expected. Even though real estate was deemed an essential service, buyers and sellers that do not have an immediate need to move are putting that move off. This is revealed by the number of new listings in April. There was only 463, compared to 847 in March, 669 is February and 596 in January. April 2020 new listings were down 45% from March 2020 and down 52% from April 2019.

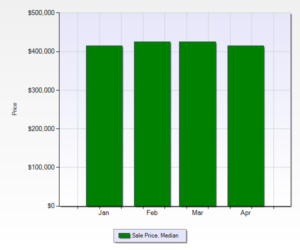

Median Sale Price/DOM

Now for the good news. Prices are relatively steady and days on market are reasonable. The median sale price in April was $415,000 compared to $424,900 in March, $425,250 in February and $415,283 in January. April 2020 sales prices were only 2% less than March 2020 and are up 4% from April 2019. Prior to Covid-19 most sellers were pricing their home below market value to create a multiple offer scenario that would have their home sell over-asking price with no conditions in about 1 week. Now that buyer traffic is down that is not an effective marketing strategy. Sellers are now more likely to price their home right at market value. This has increased the median days on market as multiple offer scenarios are down and buyers can insert conditions (like a home inspection) in their offers. In April the median DOM was 14 days, March and February were 8 and January was 10. April 2020 DOM has increased by almost a week from March 2020 and is up 4 days from April 2019.

Bank of Canada & The Future

I would be remiss if I did not mention that the Bank of Canada slashed their rate 3 times since the beginning of March bringing it to a trendsetting rate of 0.25%. That low rate is certainly assisting in keeping the real estate market active.

The million dollar question now is where will the real estate market go from here? That all depends on how quickly our city and the province can re-open for business so that we see minimal permanent job losses. The Bank of Canada’s economic outlook released in mid-April said the speed of the our rebound depends on how quickly the pandemic can be controlled. If it is controlled swiftly, the economic shock is likely to be “abrupt and deep but relatively short-lived” and followed by a strong rebound for most, but not all, sectors of the economy.

It is now the first week of May and today Ontario saw the first day of openings which leads me to believe Ontarians have done what we can to keep the pandemic under control. While the re-opening process will be slow and in stages, it is a move in a positive direction. Dare I say we can all start to see a light at the end of the tunnel? The real estate market will certainly see some dips along the way but I do believe they will be in the short term.

Have you been considering a move? Looking for a home evaluation? I’d be happy to help. Let’s chat.

Michelle